Not known Details About Lamina Loans

Little Known Facts About Lamina Loans.

Table of Contents3 Easy Facts About Lamina Loans DescribedThe Definitive Guide for Lamina LoansRumored Buzz on Lamina LoansWhat Does Lamina Loans Mean?Little Known Facts About Lamina Loans.

The big distinction between a credit report card and also an individual loan is that the card represents rotating financial obligation. The card has a collection credit scores limitation, and its owner can consistently borrow cash up to the restriction as well as settle it over time.

As an outcome of changes in the 2017 Tax Obligation Cuts as well as Jobs Act, interest on a residence equity financing is now only tax deductible if the cash obtained is used to "get, build, or considerably enhance the taxpayer's home that secures the loan," per the Internal Income Service (IRS). The most significant prospective downside is that your home is the collateral for the car loan.

Excitement About Lamina Loans

The earnings of a residence equity loan can be made use of for any type of function, yet they are frequently utilized to upgrade or increase the house. A customer thinking about a home-equity loan might bear in mind two lessons from the economic dilemma of 20082009: Home values can drop as well as up.

(HELOC) functions like a credit scores card yet utilizes the house as collateral. An optimum quantity of credit is expanded to the debtor.

However unlike a routine home-equity funding, the rates of interest is not established at the time the funding is approved. As the customer might be accessing the cash at any time over a duration of years, the rates of interest is generally variable. It may be pegged to a hidden index, such as the prime rate.

Throughout a duration of increasing prices, the passion fees on a superior equilibrium will raise. A home owner that borrows money to mount a new kitchen and also pays it off over a period of years, for example, might obtain stuck paying a lot extra in passion than anticipated, simply due to the fact that the prime rate rose - Lamina Loans.

The Basic Principles Of Lamina Loans

To take one example, the interest rate for a cash money breakthrough on the Chase Liberty credit scores card is 29. Worse yet, the cash development goes onto the credit rating card equilibrium, building up rate of interest from month to month till it is paid off.

If the missed out on repayment is an uncommon event, you might be able to call the customer support line and also demand that the charges be returned and also the rate of interest price stay the exact same. It will depend on the client service rep, however you might find clemency. Lamina Loans. Borrowing cash is just component of life for many individuals, yet how you obtain cash and exactly how much you pay for the advantage differs commonly.

Those with higher ratios typically have a lower chance of approval. Lenders might examine this information by asking for your bank declarations.

Some Of Lamina Loans

When it involves looking for a lending, maintain in mind that every lender's procedure is different. That being stated, these are the general actions you need to take when obtaining an individual finance: Find the right loan provider by comparing functions, amounts, rates of interest, terms, customer testimonials, and so on. Pick the lending institution that ideal fits your demands.

You'll be called for to give details such as: Name, Call details (address, phone number, email)Employment info (where you function, your task title)Income details (pay stubs, or bank statements to show straight deposit quantities)Wait to listen to back from the lender. This can take anywhere from a pair of hrs to a couple of days.

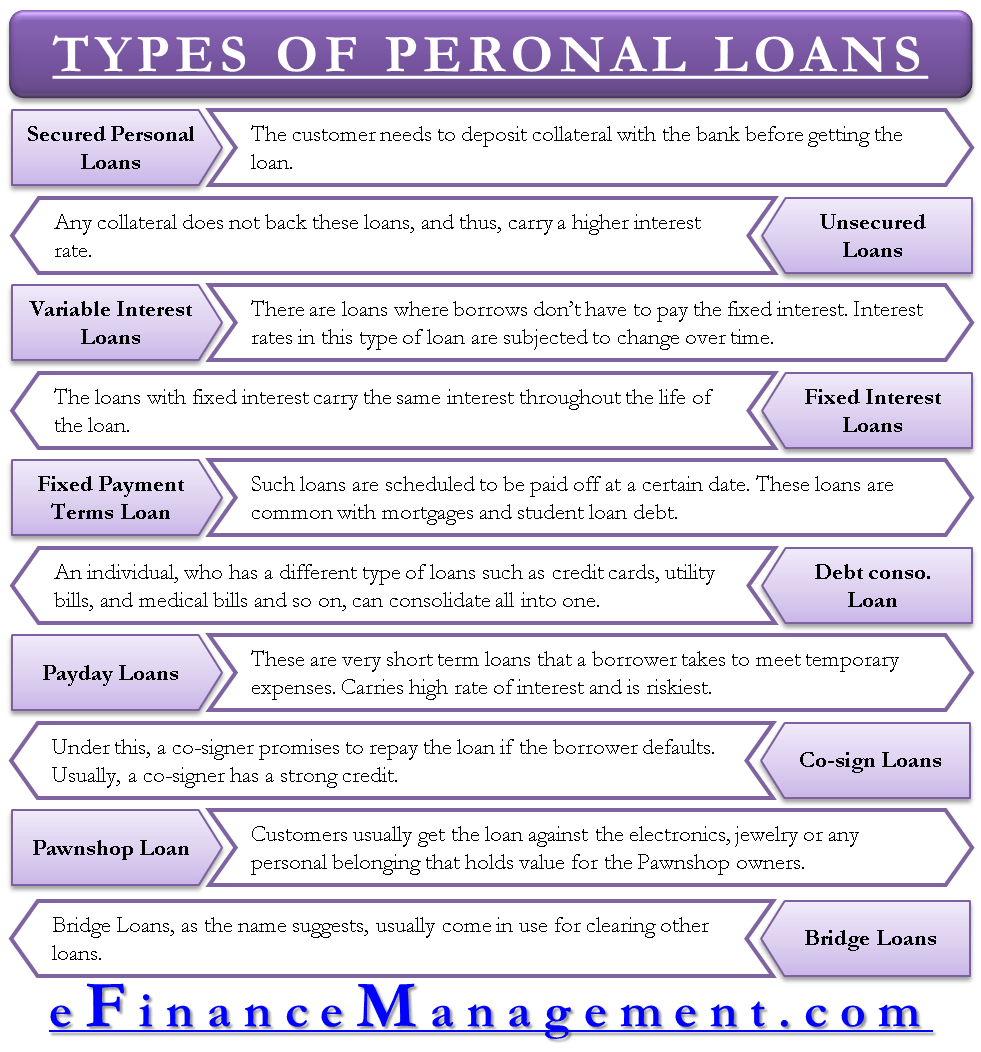

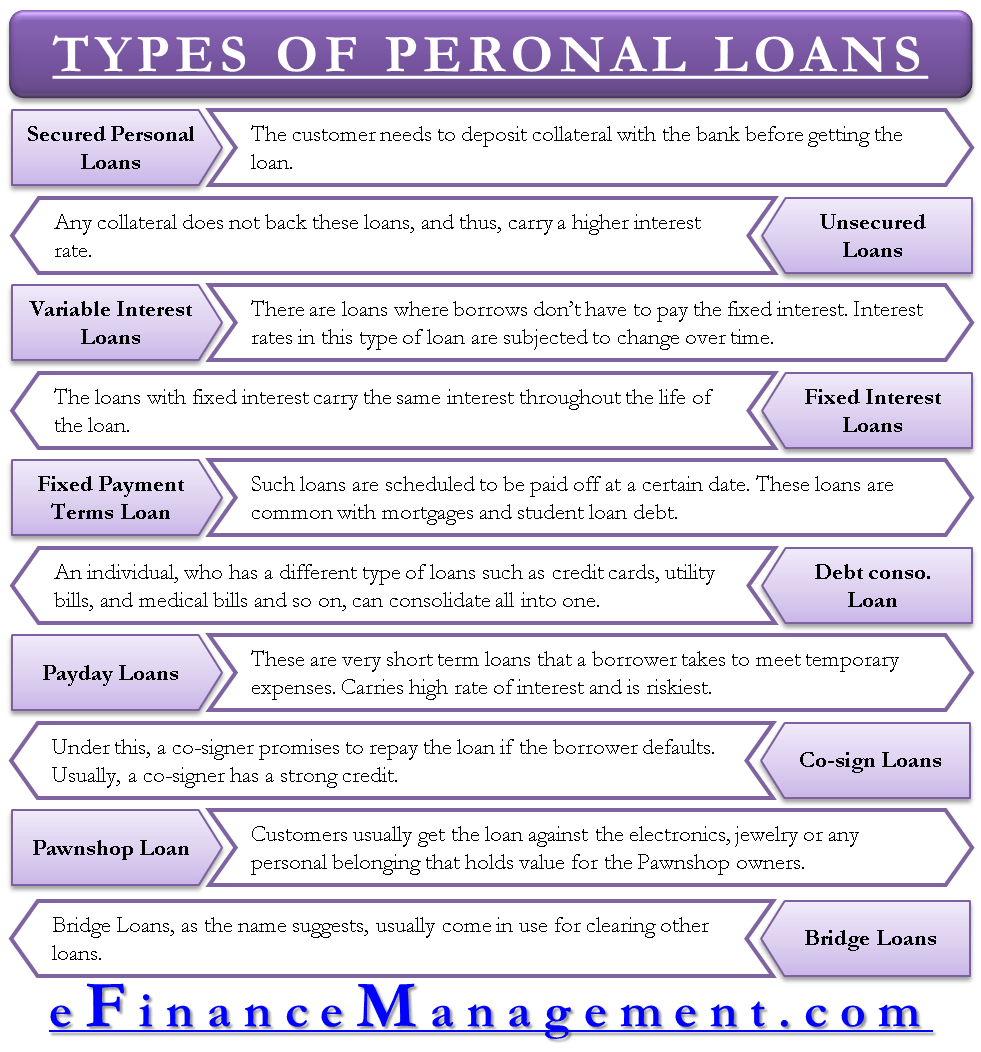

Obtain your car loan agreement, checked out through it carefully, and sign on the populated line. There are a number of various types of personal lendings you can apply for.

One means of comforting them is by supplying up one or even more possessions as compensation in case you skip on your repayments for as well why not find out more lengthy. While doing this often offers you a better chance of being authorized for a huge funding and also a reduced rate of interest to go with it, be exceptionally mindful.

Lamina Loans - Questions

Implying if you back-pedal the financing, the loan provider might charge you costs or offer your financial obligation to a debt collection agency, however it can not take any one of your assets to recover settlement. Since unprotected fundings do not involve security, the interest price you obtain is most likely to be higher than that of a safeguarded financing.

If you have bad credit report or poor financial resources and are incapable to get a personal loan, after that you need to consider getting a cosigner. A co-signer is a person who accepts take obligation for the lending in the event you skip. A co-signer is commonly somebody you recognize such as a relative or pal, nevertheless, they must have excellent credit report helpful site and finances to be approved by the loan provider.

If you have poor credit rating, you can apply with an alternative lender. These lenders have adaptable needs contrasted to more conventional banks like banks. As a matter of fact, some personal loan lenders don't call for debt checks, they just base your qualification on your general economic wellness. It's essential to keep in mind, that these loan providers typically bill greater interest prices, making them a more expensive option.

Once it's been approved, you'll pay that same rate of interest, meaning it won't raise or decrease for the period of the loan term. This sort of rate can be helpful due to the fact that it never varies, making it much easier to budget plan. A hop over to these guys variable rate, on the other hand, is mosting likely to vary based on the existing market costs, or else referred to as the "prime rate".